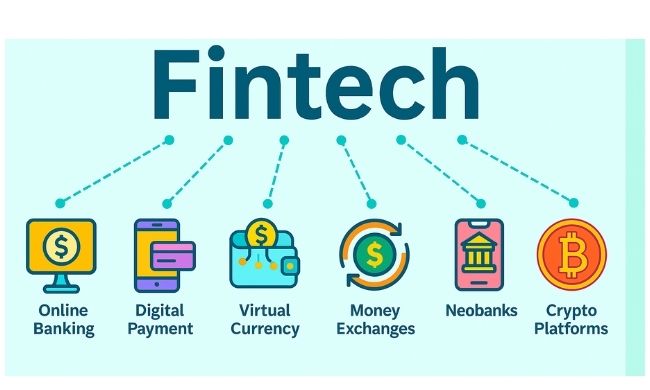

The Wallet Technologies Behind Africa’s Largest Mobile Money Networks

Africa’s leading mobile money platforms are transforming finance at scale, powered by resilient wallet technologies that enable inclusion, innovation, and billions in digital transactions across diverse markets every single day.