Every time you check your balance, transfer funds, or pay a bill, you interact with your bank’s core banking system. It runs behind the scenes as the engine powering every transaction.

Not all engines are equal. Some banks operate on systems built decades ago. Others have modernized their infrastructure. The difference affects everything from transaction speed to mobile app quality.

Here’s what separates digital core banking from legacy systems and why it matters to you.

What Is Core Banking?

Core banking handles the fundamental operations of a bank: account management, transaction processing, interest calculations, loan management, and customer data storage.

Think of it as the bank’s central nervous system. Everything connects to it.

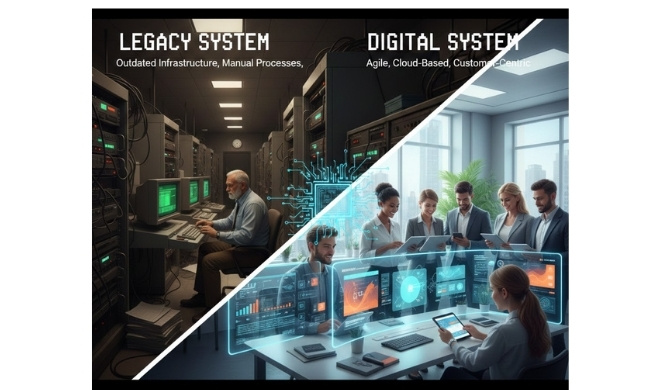

Legacy Core Banking: Built for a Different Era

Most major banks still run on systems built in the 1970s and 1980s. These mainframe computers run COBOL code written before the internet existed.

Characteristics of legacy systems:

Legacy systems use batch processing where transactions update overnight, not instantly. They feature monolithic architecture with everything bundled together. Integration capabilities are limited. Bank employees work with terminal-based interfaces. Maintenance and modifications cost significant resources.

These systems were cutting-edge when created. They handled checks, managed savings accounts, and tracked loans effectively.

They were designed for a world of physical branches and paper statements.

The Problem With Legacy

Legacy systems create real limitations.

Speed issues:

Your Monday payment might not appear until Tuesday. The system processes transactions in batches overnight. Real-time payments require complex workarounds.

Integration nightmares:

Adding mobile banking requires middleware to translate between your modern app and the ancient core system. Every new feature demands complex integration work.

Costly maintenance:

Banks spend 75% of IT budgets maintaining old systems. Finding COBOL programmers gets harder each year. A single change can take months.

Limited flexibility:

Launching a new product means modifying rigid code. Creating a specialized savings account with unique rules requires extensive programming and testing.

Data silos:

Customer information lives in separate systems. Your checking account data sits apart from loan data. Getting a complete customer view requires stitching multiple databases together.

Digital Core Banking: Built for Now

Digital core banking systems use modern technology designed for today’s banking needs.

Key features:

Digital systems process transactions in real-time with instant updates. Microservices architecture allows components to work independently. API-first design enables easy integration with other systems. Cloud-based infrastructure provides scalability and flexibility. Modern programming languages replace outdated code. Modular structure lets you swap components without rebuilding everything.

These systems represent fundamental differences, not just faster versions of legacy platforms.

How Digital Systems Work Differently

Real-time everything:

Transfer money and it moves immediately. Check your balance and see actual current data, not yesterday’s snapshot.

Plug-and-play features:

Adding cryptocurrency trading requires installing a module. Integrating with a fintech partner uses the API. Changes take weeks, not months.

Better customer experience:

Real-time system updates mean your app shows accurate information. Easy integration allows your bank to offer more services.

Lower costs over time:

Cloud infrastructure scales with demand. You avoid massive data centers. Updates happen remotely. Maintenance costs drop.

Data intelligence:

Modern systems centralize customer data. Banks can offer personalized recommendations, spot fraud faster, and understand customer needs better.

Real-World Impact

Example 1: Instant payments

Legacy bank: You send money Friday evening. It arrives Monday morning after batch processing.

Digital bank: You send money Friday evening. It arrives in seconds.

Example 2: New product launch

Legacy bank: Creating a high-yield savings account takes 6 to 12 months of development and testing.

Digital bank: Configure and launch in weeks using existing modules.

Example 3: Partner integration

Legacy bank: Partnering with a budgeting app requires custom middleware development costing hundreds of thousands.

Digital bank: Provides API access with integration complete in days.

Why All Banks Haven’t Switched

If digital systems are better, why do major banks still use legacy platforms?

The migration challenge:

Moving billions of accounts and decades of transaction history carries risk. One error could lock customers out of their money.

The cost:

Replacing core banking costs hundreds of millions. Large banks might spend $1 billion on migration.

The disruption:

During migration, some services might be limited. Customers notice even minor hiccups.

The working system:

Legacy systems work despite limitations. They’re tested and stable. “If it ain’t broke” becomes powerful when dealing with people’s money.

Regulatory complexity:

Banks must prove new systems meet compliance requirements. Getting regulatory approval adds time and cost.

The Hybrid Approach

Many banks take a middle path. They keep legacy cores but add modern layers on top.

The strategy:

The legacy core continues handling basic account management. A modern API layer sits between core and customer-facing apps. New services run on separate cloud platforms. Functions migrate gradually to digital systems.

This reduces risk but limits benefits. You get better apps but still deal with batch processing delays.

What This Means for You

If your bank runs legacy systems:

You experience slower transaction processing, fewer innovative features, less integrated services, and potentially higher fees as maintenance costs get passed along.

If your bank runs digital systems:

You benefit from instant updates and transfers, more third-party integrations, faster new feature rollouts, and often lower fees since digital-first banks have lower overhead.

You can usually tell by the experience. Does your balance update instantly? Can you easily connect budgeting apps? Does the bank regularly add new features?

The Future of Banking Infrastructure

The trend is clear. Digital core banking will become standard.

What drives change:

Customer expectations demand instant everything. Competition from fintechs challenges traditional banks as startups built on digital cores from day one. Regulatory pressure pushes for real-time payment systems. Cost pressures make maintaining legacy systems unsustainable.

The timeline:

Major banks are migrating gradually. Most will transition over the next 10 to 15 years. Smaller banks and new entrants are already digital.

Choosing a Bank Based on Infrastructure

You don’t need to ask about COBOL versus microservices. Just test the experience.

Send money to a friend. How long does it take? Check if third-party apps connect easily. Notice how often new features appear. Look at transaction processing times.

Digital infrastructure creates better banking. Legacy systems work but limit what’s possible.

The bank running tomorrow’s technology today will serve you better than one maintaining yesterday’s systems.

Your money deserves infrastructure built for the speed of modern life.

For Digital banking system partners in Africa email info@finhive.africa / TOP 10 Digital banking Vendors in Africa